Market Insights

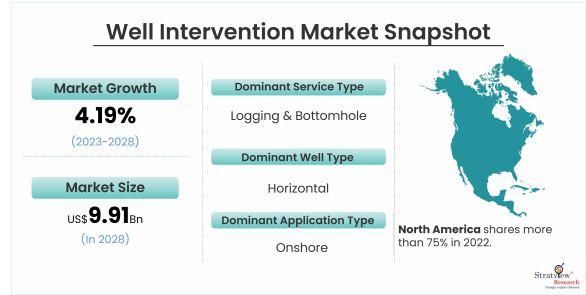

The well intervention market is estimated to grow from USD 7.73 billion in 2022 to USD 9.91 billion by 2028 at a CAGR of 4.19% during the forecast period.

Read more: https://www.stratviewresearch.com/Request-Sample/1748/well-intervention-market.html#form

What is the well intervention?

Well Intervention targets the crux and explains the basic tools and techniques available for producing the below potential. This process of well-servicing operations is conducted within completed wellbores.

Well Intervention is a well testing process carried out on oil & gas during its fruitful life that changes the state of the well and provides diagnostics and manages the efficient production of the well.

Key Players

Some of the major players in the market are-

- Weathe

- Expro Group

- Halliburton

- Schlumberger

- BHG

- NOV, Inc. (US)

- Superior Energy Services, Inc.

- Archer

- Altus Interventio

- Oilserv

- Welltec.

Market Dynamics

Growing Discoveries in the Oil & Gas Industry to Boost Growth

The growing number of oil and gas discoveries in oilfield reserves and technological advancements are driving well-intervention market growth. Key discoveries include Alaska, Golan Heights, Alpine High, Stabroek Block, Yellowtail, and Haimara. An expected increase in oil prices could encourage investment in exploration activities.

Growing Initiatives to Increase Production from Aging Wells will Propel Growth

The integration of efficient production techniques and advanced equipment in oil and gas wells is expected to boost market growth, increase tubing life, reduce risks, and enhance efficiency.

RESTRAINING FACTORS

Focus on Renewable Energy and stringent Regulations for Protecting the Environment

Renewable energy sources and strict regulations in the oil and gas industry are expected to hinder market growth, with renewable energy accounting for 49% of global electricity output by 2050. Countries are also implementing strict environmental regulations.

Opportunities

Surge in demand for offshore and subsea well intervention

The exploration and production division is experiencing a surge in demand for offshore and subsea exploration due to aging onshore wells and the need for more intervention services. High investments are being made to explore and drill new wells in offshore areas, but there is a significant gap in offshore well counts compared to onshore wells. Technological advancements have made offshore production economical, leading to the expansion of oilfield services in offshore regions.

Research Methodology

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles have been leveraged to gather the data.

We conducted more than 10 detailed primary interviews with the market players across the value chain in all four regions and with industry experts to obtain both qualitative and quantitative insights.