Introduction:

In the dynamic landscape of aviation, ensuring the safety and reliability of aircraft is paramount. Aircraft Health Monitoring Systems (AHMS) have emerged as a groundbreaking technology, reshaping the way airlines and aviation stakeholders approach maintenance and operational efficiency. This article explores the transformative impact of AHMS on the aviation industry, delving into its key components, market trends, challenges, and future prospects.

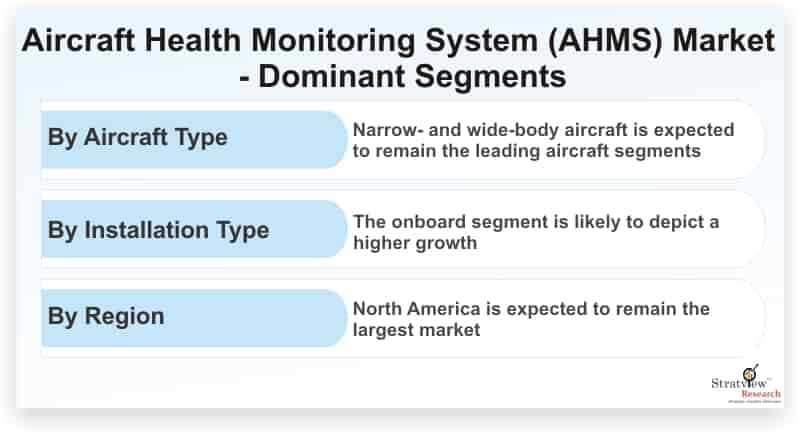

The aircraft health monitoring system market (AHMS) is estimated to grow from USD 3.87 billion in 2022 to USD 7.01 billion by 2028 at a CAGR of 10.26% during the forecast period.

Health monitoring systems are gaining momentum in the aircraft industry as all the major aircraft OEMs are increasingly incorporating these systems into their best-selling aircraft in order to enhance flight safety as well as to reduce MRO costs.

Several factors are bolstering the demand for health monitoring systems in the aircraft industry. Some of these are-

Rising demand for advanced aircraft monitoring systems to reduce the increasing number of aircraft accidents

Increasing production rates of key aircraft programs

Surging situational cognizance and cost-effective maintenance

Increasing demand for connected aircraft solutions

Effective decision-making due to the availability of real-time information

The inception of a structural health monitoring system, a paradigm shift from non-destructive testing, has paved the path for enhanced aircraft health monitoring systems.

Key Players

Some of the major players in the AHMS market are

Airbus S.A.S.

The Boeing Company

United Technologies Corporation

Honeywell International Inc.

General Electric Company

Rockwell Collins, Inc.

Meggitt PLC

Rolls-Royce Holdings PLC

Safran S.A.

Air France Industries KLM Engineering & Maintenance

Lufthansa Technik AG.

These major players are likely to remain the most dominant ones over the next five years as well. Several efforts are being made by these players to remain competitive and to quickly gain more shares in the market. Some of which are a regional expansion, execution of mergers & acquisitions and joint ventures, and advancement in technologies.

Research Methodology

For calculating the market size, our analysts follow either Top-Bottom or Bottom-Top approach or both, depending upon the complexity or availability of the data points. Our reports offer high-quality insights and are the outcome of detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders and validation and triangulation with Stratview Research’s internal database and statistical tools. We leverage multitude of authenticated secondary sources, such as company annual reports, government sources, trade associations, journals, investor presentation, white papers, and articles to gather the data. More than 10 detailed primary interviews with the market players across the value chain in all four regions and industry experts are usually executed to obtain both qualitative and quantitative insights.