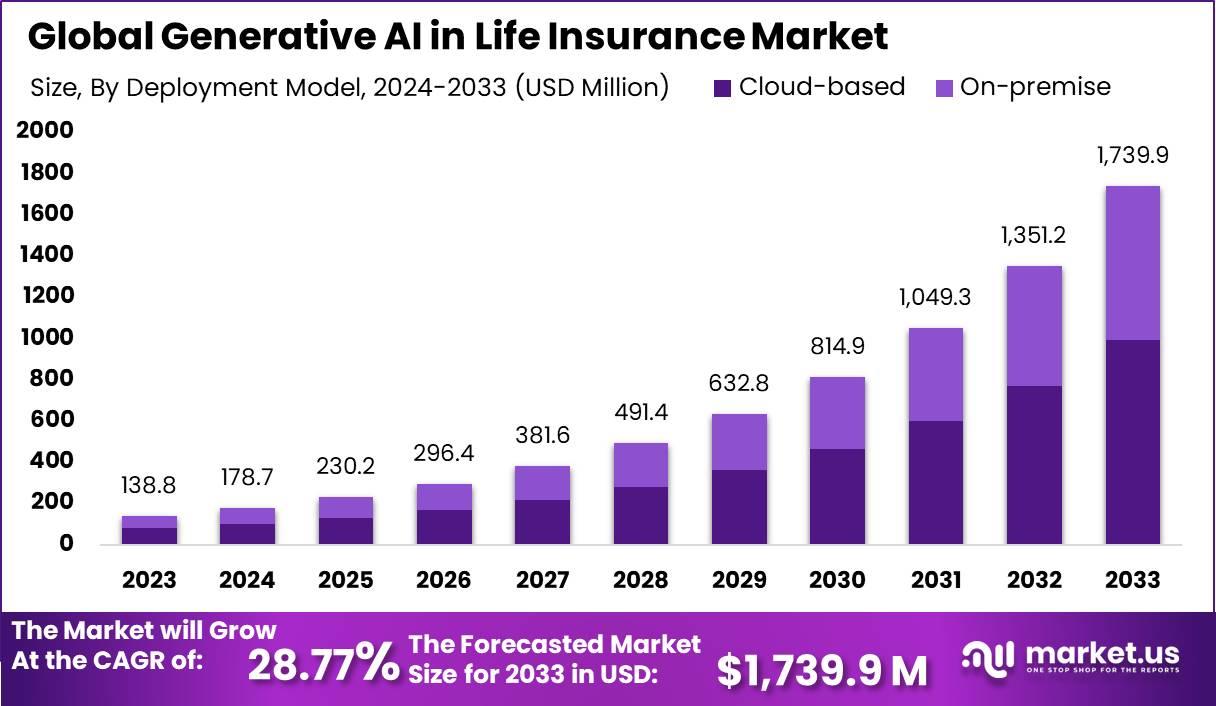

The Global Generative AI in Life Insurance Market is poised for substantial growth, with projections indicating a notable increase in value over the forecast period. By 2033, the market is expected to reach a worth of USD 1,726.7 million, marking a significant growth rate of 4.5%. This growth is driven by various factors, including advancements in technology, increasing demand for data-driven decision-making tools, and evolving consumer expectations for personalized insurance solutions.

Generative AI, also known as artificial intelligence, holds tremendous potential in the life insurance sector. It involves the use of advanced algorithms and machine learning techniques to generate personalized insights, predictions, and recommendations based on extensive data analysis. This technology enables insurers to improve risk assessment accuracy, personalize underwriting processes, and enhance overall customer experiences.

Key segments within the Generative AI in Life Insurance Market include deployment models, technology types, applications, and end-users. Cloud-based solutions dominate the market, capturing over 70% share in 2023. This dominance is attributed to the scalability, flexibility, and cost-effectiveness offered by cloud-based platforms. Natural Language Processing (NLP) emerges as a crucial technology segment, holding a dominant market position with over 52% share in 2023. NLP plays a pivotal role in transforming customer interactions, streamlining claims processing, and ensuring compliance and fraud detection.

Among applications, Personalized Policy Recommendations lead the market, capturing over 25% share in 2023. This segment's growth is driven by the increasing demand for customized insurance products tailored to individual customer needs and preferences. In terms of end-users, Life Insurance Companies dominate the market, capturing a significant share of more than 30% in 2023. This dominance is attributed to leveraging generative AI for accurate risk assessment, personalized underwriting, and enhancing actuarial capabilities.

Regionally, North America leads the market with a dominant share of over 32% in 2023. This leadership position is supported by a mature and technologically advanced life insurance industry, robust digital infrastructure, and high insurance awareness among the population.

Despite the market's promising outlook, several challenges and opportunities exist. Data privacy and security concerns emerge as significant restraints, necessitating substantial investments in cybersecurity measures and data governance frameworks. However, opportunities for market penetration in emerging economies present significant growth potential, driven by a growing middle class and increasing digital literacy.

In conclusion, the Generative AI in Life Insurance Market presents lucrative opportunities for insurers to enhance customer experiences, improve operational efficiency, and gain a competitive edge in the evolving landscape of the insurance industry. By leveraging advanced AI technologies, insurers can navigate challenges, capitalize on opportunities, and drive sustainable growth in the market.

Source of information: https://market.us/report/generative-ai-in-life-insurance-market/