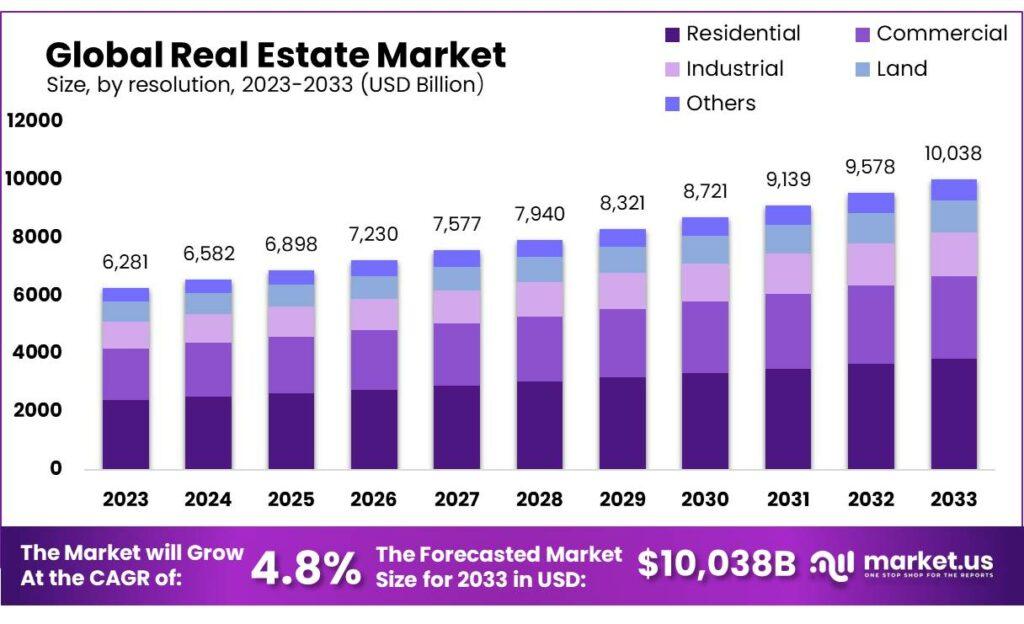

Real Estate Market size is expected to be worth around USD 10038 Billion by 2033, from USD 6281 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The real estate market refers to the collective activities and conditions that influence the buying, selling, and leasing of properties. It encompasses various types of real estate, including residential, commercial, industrial, and agricultural properties.

The market operates through the interactions between buyers, sellers, landlords, tenants, and real estate professionals such as brokers, agents, and developers.

Factors influencing the real estate market include economic indicators, interest rates, government policies, demographic trends, and the overall supply and demand dynamics.

In addition to economic factors, the real estate market is also shaped by regulatory and environmental considerations. Government policies, such as tax incentives, zoning laws, and building codes, play a crucial role in determining the development and utilization of land. Environmental factors, including location, climate, and natural disasters, also impact property desirability and market stability.

Real Estate segmentation

Based on Property

-

Residential

-

Commercial

-

Industrial

-

Land

-

Other Properties

By Property Type

-

Fully Furnished

-

Semi Furnished

-

Unfurnished

Based on Business

-

Sales

-

Rental

-

Lease

Based on Mode

-

Online

-

Offline

In 2024, the real estate market saw the residential segment dominate with over 38.3% share, including single-family homes, apartments, and condominiums, catering to individuals and families.

Fully furnished properties led the market with a 41.6% share, appealing to those seeking immediate occupancy, followed by semi-furnished and unfurnished properties. The rental segment captured over 54.5% of the market, providing flexibility, while sales and long-term leases remained significant.

Offline transactions dominated with over 76.3% of the market, but online transactions grew rapidly, driven by increased technology use and the pandemic's push towards digital tools.

Market Key Players

-

Brookfield Asset Management Inc.

-

CBRE Global Investors

-

CBRE Group, Inc.

-

Colliers International Group Inc.

-

Cushman & Wakefield

-

Digital Realty Trust, Inc.

-

Equity Residential

-

Hines

-

Host Hotels & Resorts, Inc.

-

Jones Lang LaSalle (JLL)

-

Knight Frank LLP

-

Lendlease Corporation Limited

-

Mitsui Fudosan Co., Ltd.

-

Newmark Group, Inc.

-

Prologis, Inc.

-

Savills plc

-

Simon Property Group, Inc.

-

The Blackstone Group Inc.

-

Unibail-Rodamco-Westfield SE

-

Vornado Realty Trust

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/real-estate-market/request-sample/

Drivers:

The real estate market is primarily driven by economic growth and increasing urbanization. As economies expand, there is a corresponding rise in disposable incomes, which boosts demand for residential, commercial, and industrial properties. Urbanization leads to greater demand for housing and infrastructure development, spurring investment in real estate projects.

Restraints:

A significant restraint in the real estate market is economic uncertainty, which can lead to reduced consumer confidence and investment. Fluctuating interest rates directly impact mortgage affordability, potentially decreasing demand. Stringent government regulations, including zoning laws, building codes, and environmental restrictions, can also impede real estate development.

Opportunities:

The real estate market offers numerous opportunities through the growing demand for sustainable and smart buildings. There is an increasing emphasis on green building practices and energy-efficient properties, driven by environmental concerns and regulatory requirements. This creates a niche market for eco-friendly real estate projects. Additionally, advancements in technology, such as smart home systems and IoT, present opportunities for developers to offer innovative and attractive properties.

Challenges:

One of the major challenges in the real estate market is the high cost of land and construction, which can limit profitability and accessibility, particularly in urban areas. Market saturation in certain regions can lead to increased competition and reduced margins for developers. The real estate industry also faces challenges related to financing, as obtaining capital for large projects can be complex and risky.