Digital Payment Market Growth or Demand Increase or Decrease for what contains ?

Digital Payment Market CAGR Estimation:

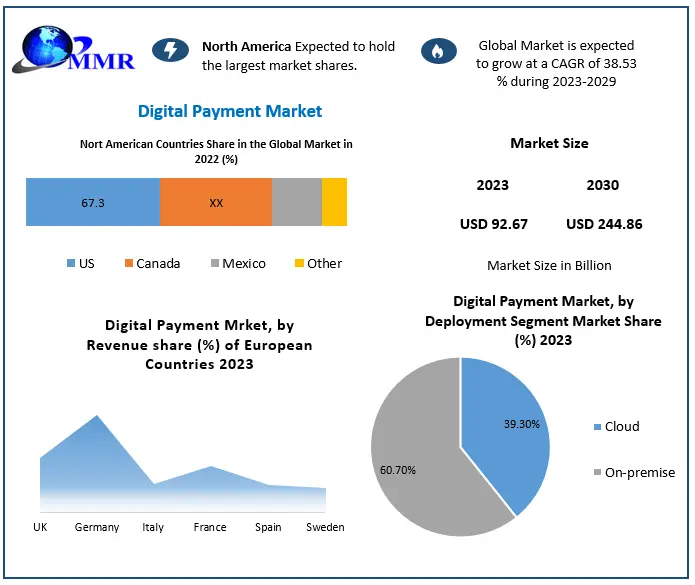

The size of the digital payment market was estimated to be USD 92.67 billion in 2023. From 2024 to 2030, the total income from digital payments is predicted to expand at a compound annual growth rate (CAGR) of 14.89%, to reach approximately USD 244.86 billion.

Digital Payment Market Segmentation:

by Component

Solution

Service

by Deployment

Cloud

On-premise

In 2023, the on-premise segment held a dominant market share of around 65.0% of worldwide revenue, based on deployment. Businesses that use on-premises digital payment solutions have total control over their apps and systems, which is easily managed by their IT staff. Additionally, businesses use in-house digital payment solutions to safeguard their apps and systems against malicious attacks. For instance, in November 2019, Microsoft and ACI Global announced their alliance. The partnership provided lower long-term capital expenditure and increased security for ACI Worldwide's on-premises customers.

by Vertical

BFSI

Media & Entertainment

IT & Telecommunication

Hospitality

Healthcare

End-user revenue-wise, the BFSI sector led the market in 2023, accounting for over 23% of worldwide revenue. Remittance expansion to low- and middle-income countries is expected to be one of the main drivers of new market development opportunities over the projection period. Banks are also improving their ability to compete with companies like Google, Amazon, and Facebook that offer digital payment solutions. To make things simpler for its customers, Bank of America, for instance, introduced a digital debit card in June 2019.

Click here for a more detailed explanation :https://www.maximizemarketresearch.com/request-sample/16835/

Digital Payment Market Growth or Demand in which regions?

The competitive landscape of theDigital Payment Market market encompasses aspects like technology adoption, financial strength, portfolio, mergers and acquisitions, joint ventures, and strategic alliances. A comprehensive report delves into the drivers, limitations, opportunities, and challenges inherent in theDigital Payment Market market. The report employed a bottom-up approach to ascertainDigital Payment Market market estimations and growth rates.To gain insights intoDigital Payment Market market penetration, pricing dynamics, demand analysis, and competitive panorama, the report executed regional analysis at local, regional, and global levels. Essential details about theDigital Payment Market market, including stakeholders, investors, and new entrants, are presented to facilitate the development of marketing strategies and investment plans.Both primary and secondary data gathering techniques were employed for theDigital Payment Market r . Primary approaches involved surveys, questionnaires, and interviews with industry leaders and business proprietors, while secondary data encompassed sources like press releases, annual and financial reports, white papers, etc. SWOT analysis was leveraged to pinpoint market vulnerabilities and weaknesses, while the PORTER framework was applied to gauge industry competitiveness within theDigital Payment Market .

Click here for a more detailed explanation :https://www.maximizemarketresearch.com/request-sample/16835/

Digital Payment Market Key Players:

1. Total System Services, Inc.

2. PayPal Holdings Inc

3. ACI Worldwide Inc

4. Dwolla

5. FattMerchant

6. FIS and Fiserv

7. Intuit

8. JPMorgan Chase

9. Square

10. Stripe

11. Visa and Mastercard

Europe:

1. Wirecard AG.

2. Novetti Group Limited

3. Adyen N.V.

4. Aurus

5. Worldline

6. Checkout

Asia Pacific:

1. Lianta Payments

2. Alipay

3. PayU

Global:

1. Apple Pay

2. Paysafe

3. PayTrace

4. Spreedly

5. WEX

For an in-depth analysis, click the provided link:https://www.maximizemarketresearch.com/market-report/digital-payment-market/16835/

Key questions answered in the Digital Payment Market are:

- What is Digital Payment Market ?

- What is the growth rate of the Digital Payment Market ?

- Which are the factors expected to drive the Digital Payment Market market growth?

- What are the different segments of the Digital Payment Market ?

- What are the factors restraining the growth of the Digital Payment Market ?

- What is the demand pattern of the Digital Payment Market ?

- What major challenges could the Digital Payment Market face in the future?

Related Reports:

Global Esoteric Testing Market https://www.maximizemarketresearch.com/market-report/global-esoteric-testing-market/1297/

Global Conductive Polymer Market https://www.maximizemarketresearch.com/market-report/global-conductive-polymer-market/31525/

Key Offerings:

- Past Size and Competitive Landscape

- Past Pricing and price curve by region

- Size, Share, Size Forecast by different segment

- Dynamics Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Segmentation A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape Profiles of selected key players by region from a strategic perspective

About Maximize Research:

Maximize Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656