Overview

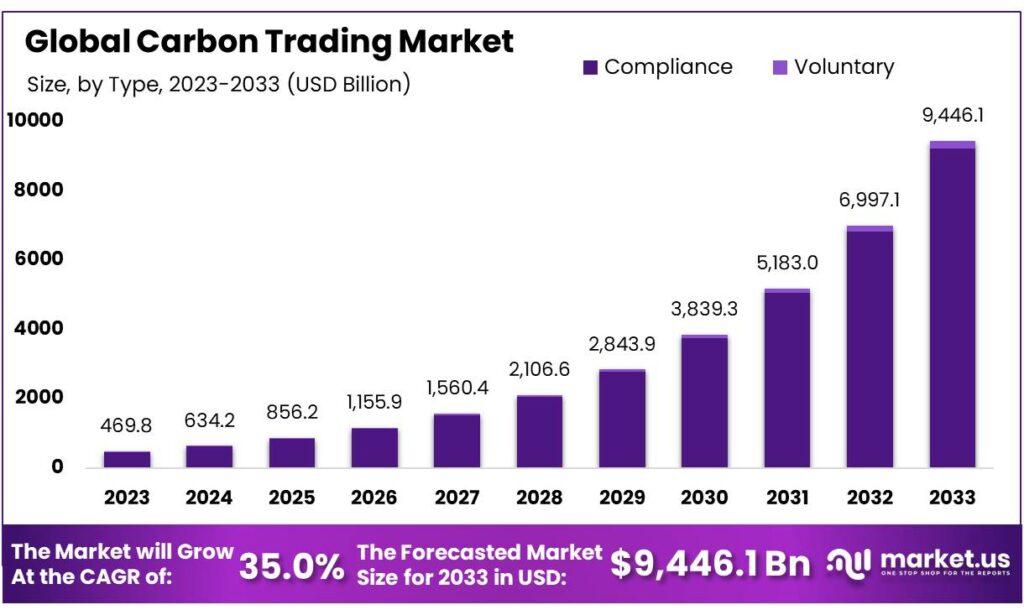

Global Carbon Trading Market size is expected to be worth around USD 9446.1 billion by 2033, from USD 469.8 billion in 2023, growing at a CAGR of 35.0% during the forecast period from 2023 to 2033.

The carbon trading market is a system where countries, companies, or organizations can buy and sell carbon credits to meet their greenhouse gas emission targets. Each carbon credit represents the right to emit one ton of carbon dioxide or an equivalent amount of another greenhouse gas.

The goal of this market is to reduce overall emissions by setting a cap on the total amount of greenhouse gases that can be emitted. Entities that reduce their emissions below their allotted amount can sell their excess credits to those that exceed their limits, creating a financial incentive for reducing emissions.

This market plays a crucial role in global efforts to combat climate change. By putting a price on carbon emissions, it encourages companies to invest in cleaner technologies and more sustainable practices. The carbon trading market is growing as more regions implement cap-and-trade systems and carbon pricing mechanisms. This growth is driven by increasing regulatory pressure and public awareness of the need for environmental responsibility. As the market expands, it provides opportunities for businesses to innovate and develop new solutions to reduce emissions, contributing to a more sustainable future.

Market Key Segments

By Type

-

Compliance

-

Voluntary

By Project Type

-

Avoidance/Reduction Projects

-

Removal/Sequestration Projects

By End-Use

-

Power

-

Energy

-

Aviation

-

Transportation

-

Industrial

-

Others

Download a sample report in MINUTES@https://market.us/report/carbon-trading-market/request-sample/

In 2023, the Carbon Trading Market saw Compliance lead with a dominant 97.8% share, driven by regulatory mandates that spurred substantial growth. The emphasis on meeting emission reduction standards boosted demand for compliance credits.

Avoidance/Reduction Projects dominated by project type, securing a 65.8% share as businesses focused on reducing or avoiding greenhouse gas emissions, driven by the global push for sustainability. In terms of end-use, the Power sector emerged as the leader with a 32.5% share, reflecting its active engagement in carbon trading to meet emission reduction targets and transition to cleaner energy sources.

Market Key Players

-

NativeEnergy

-

CarbonBetter

-

ClearSky Climate Solutions

-

EKI Energy Services Limited

-

Finite Carbon

-

Torrent Power Limited

-

South Pole Group

-

3Degrees Group, Inc.

-

WGL Holdings Inc.

-

Carbon Care Asia Ltd.

Driver: The carbon trading market is primarily driven by regulatory policies and international agreements aimed at reducing carbon emissions. Frameworks established by bodies like the UNFCCC and its Paris Agreement mandate or encourage emission reductions and include mechanisms like the Clean Development Mechanism (CDM) for trading emission reduction credits. These policies compel industries to adopt cleaner technologies, boosting demand for carbon credits.

Restraint: A significant restraint is the complexity and lack of standardization across different carbon trading schemes. Varying rules, eligibility criteria, and credit types create confusion and inefficiencies, discouraging participation and limiting the market's effectiveness in reducing emissions.

Opportunity: Corporate sustainability commitments present a significant opportunity. As more companies pledge to achieve carbon neutrality or net-zero emissions, driven by consumer demand, investor pressure, and the anticipation of stricter regulations, the demand for carbon credits increases. This trend expands the voluntary carbon market and encourages the development of new projects that generate tradable offsets.

Challenge: Concerns over market integrity pose a challenge. Issues related to the additionality, permanence, and potential for greenwashing can undermine confidence in the carbon trading market. Critics argue that some offset projects may not deliver genuine emission reductions, affecting demand for credits and stakeholder engagement.