Automotive Relay Industry Overview

The global automotive relay market size was valued at USD 13.53 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2030.

Electric automotive parts have diversified over the past decade, leading to an increase in the number of relays used as switching devices and variation in the required features of each relay. The industry is expected to witness steady growth over the forecast period owing to advancements in miniaturization and high contact capability development to address restrictions in mounting space in the Electric Control Unit (ECU) of vehicles.

Electric automotive parts have diversified, thereby increasing the number of relays used for switching; different features are required for each relay. Further miniaturization and high contact capability development are needed, especially in the Electric Control Unit (ECU), where there are restrictions in mounting space due to the presence of a cluster of relays. A high degree of reliability in relays is required from a safety point of view. Components equipped with features such as latching, low noise, and ultra-miniaturization have gained prominence owing to the need to provide switching technology for the latest generation of electronic functions in a car.

Gather more insights about the market drivers, restrains and growth of the Automotive Relay Market

The average number of relays installed per vehicle is expected to increase over the forecast period due to the growing adoption of sophisticated electronic equipment and increased emphasis on safety and security. Switching supplementary devices required for safety, security, communications, and infotainment requires additional relays apart from those used in powertrain systems. Increased developments in PCB relays to decrease the overall vehicular weight for increasing fuel efficiency are expected to fill market growth over the forecast period.

With the automotive industry's transition from hardware to software-oriented vehicles, the average number of software and electronics per vehicle is rising rapidly. New features are integrated into vehicles using electronic devices with a wide range of application areas, such as safety management, powertrain, comfort, and infotainment, which employ automotive relays. This is expected to boost the demand in the market during the forecast period.

Passenger safety is another important factor in driving the adoption of automated automobile systems. Vehicle safety features have contributed remarkably to reducing road accidents and fatalities over the last few decades. Also, the automotive industry is working to transform consumers' driving experience. Smarter cars capable of performing self-diagnosis are gaining popularity and are anticipated to augment the market's growth during the forecast period.

The lack of standardization and highly competitive players in relay manufacturing hinder the growth of the global market. During the operation of an automotive relay, large amounts of heat are generated, and other factors, such as durability limitations and switching noise, are expected to hamper the market growth.

The growing demand for hybrid and electric vehicles with advanced, lightweight, and high-performance relays is compelling manufacturers to invest in solid-state relays compared to traditional large electromechanical relays. Thus, this is anticipated to act as an opportunity for the market to grow.

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

- The global electric van market size was estimated at USD 13.33 billion in 2023 and is expected to grow at a CAGR of 13.8% from 2024 to 2030.

- The global automotive night vision system market was estimated at USD 3.66 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030.

Automotive Relay Market Segmentation

Grand View Research has segmented the global automotive relay market based on product, vehicle type, application, and region:

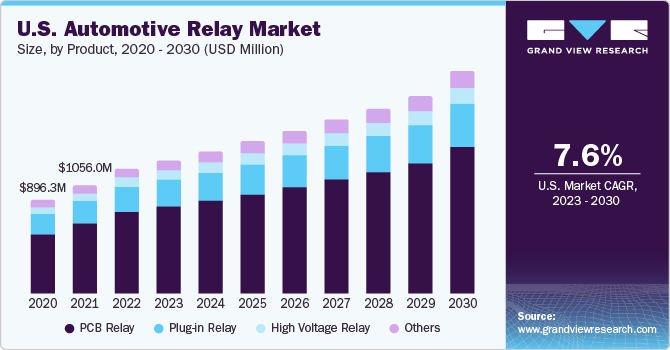

Automotive Relay Product Outlook (Revenue, USD Million, 2017 - 2030)

- PCB Relay

- Plug-in Relay

- High Voltage Relay

- Others

Automotive Relay Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

Automotive Relay Application Outlook (Revenue, USD Million, 2017 - 2030)

- Resistive Loads

- HVAC

- Capacitive Loads

- Engine Management Module

- Fog Lights

- ABS Module

- Front and Rear Beam

- Inductive Loads

- Power Window

- Central Lock

- Cooling Fan

- Clutches

Automotive Relay Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

Key Companies profiled:

- ABB

- American Zettler, Inc. (Zettler Components, Inc.)

- BETA ELECTRIC INDUSTRY CO., LTD

- COTO TECHNOLOGY

- Sensata Technologies Holdings N.V

- Deltrol Controls (Deltrol Corporation)

- DENSO CORPORATION

- Eaton

- Fujitsu Limited

- GOOD SKY ELECTRIC CO., LTD.

- IDEC Corporation

- Hella KGaA Hueck & Co. (HELLA)

Recent Developments

- In March 2023, Panasonic Industry Europe GmbH launched its latest relay, the HE-R, which has undergone extensive testing for enhanced short-circuit performance. This relay is designed to provide a reliable and safe solution for electric vehicle (EV) charging industry customers. The HE-R relay has successfully passed the rigorous IEC62955 test, which involves a demanding 10kA short circuit assessment. Furthermore, the smaller HE-S relay complies with the IEC62955 standard for 3kA short circuits.

- In February 2023, ABB launched the Relay Retrofit Program, which aims to replace specific SPACOM protection relays with advanced REX610 protection and control technology. The all-in-one REX610 relay is specifically designed to accommodate the changing requirements of modern power grids, making it a versatile, environmentally friendly, and future-ready option. The Retrofit Program enables customers to schedule and implement their retrofit projects in stages, ensuring prompt replacement while minimizing disruptions to production or power distribution operations

- In May 2022, Texas Instruments launched a new range of solid-state relays to enhance the safety of electric vehicles (EVs). This portfolio includes isolated drivers and switches that meet automotive standards, ensuring exceptional reliability. Furthermore, these isolated solid-state relays offer the smallest solution size available in the market, effectively reducing the cost of bill-of-materials (BOM) and powertrain expenses for 800-V battery-management systems.

Order a free sample PDF of the Automotive Relay Market Intelligence Study, published by Grand View Research.