The yield curve in the United States inverts, signaling a possible recession.

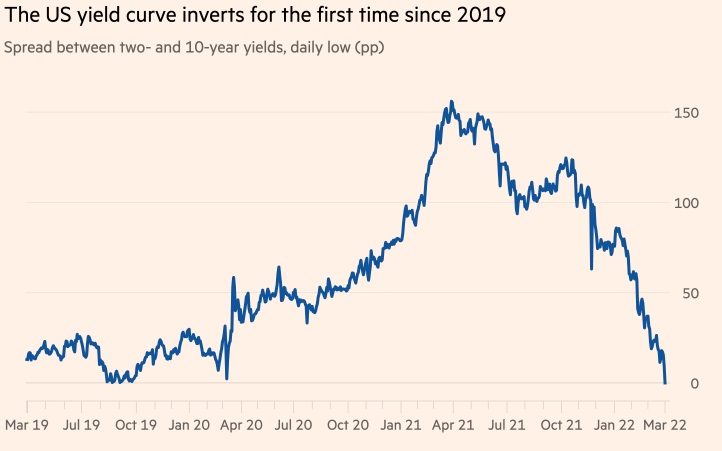

For the first time since August 2019, two-year Treasury yields have surpassed 10-year yields.

On Tuesday, a carefully watched recession indicator flashed red, as investors worried that the Federal Reserve's efforts to control inflation might result in a significant downturn in the US economy.

For the first time since August 2019, two-year Treasury note yields surpassed those of the 10-year Treasury note, inverting a part of the yield curve highly watched by Wall Street and policymakers. Inversions have preceded every US recession in the last 50 years, signaling concern about the economy's long-term growth prospects.

An inversion of this yield curve indicator is usually followed by a recession two years later.

Two-year rates, which move in lockstep with interest rate expectations, climbed to 2.45%, the highest level since March 2019. The two-year yield has risen 1.64 percentage points this year as the US Federal Reserve tightened monetary policy, including raising interest rates for the first time since 2018 to combat 40-year-high inflation.

The 10-year yield, which is affected by inflation and economic predictions, has dropped to 2.38 percent. The benchmark yield has also climbed this year, albeit at a slower pace, as the Federal Reserve has tightened its monetary policy, lowering inflation and growth expectations.

The yield curve immediately expanded after inverting, and it went positive again, hovering around 0.02 percentage points. It was 0.77 percentage points at the start of the year.

Another gauge of the yield curve, the spread between five- and 30-year yields, reversed for the first time since 2006.

Investors think that because of the Fed's huge bond purchases during the coronavirus outbreak, the inversion may not be as good a recession indicator this time around.

"Markets will be concerned about the yield curve inversion," said Gennadiy Goldberg, a US rates analyst at TD Securities.

However, he added that these inversions "may potentially be distorted due to the Fed's massive Covid quantitative easing program."

The Fed began buying large tracts of US government debt to shore up the economy as part of its financial market intervention amid the market meltdown in March 2020. The Fed's $120 billion-per-month bond-buying program came to an end this month, and the influx of Treasuries into the market has pushed prices lower and yields higher.

Investors are bracing for the Fed to deliver a half-point rate hike as soon as its May meeting, as expectations have risen that it will accelerate the pace at which it tightens monetary policy.

Normally, the central bank moves in quarter-point increments, as it did earlier this month, but rising inflationary pressures have raised the possibility of more aggressive action.

Some officials have also proposed that interest rates should be raised above the so-called neutral rate, which is expected to reach 2.4 percent this year.

Because of the Fed's interference, this yield curve inversion could be driven by market technical issues rather than economic fundamentals.

Traditional indicators of a faltering economy are also absent. As it recovered from the pandemic-driven recession that lasted for the first two quarters of 2020, the US economy increased at its fastest annual rate since 1984 last year. In recent months, the labor sector has also roared back, with robust employment growth reported.