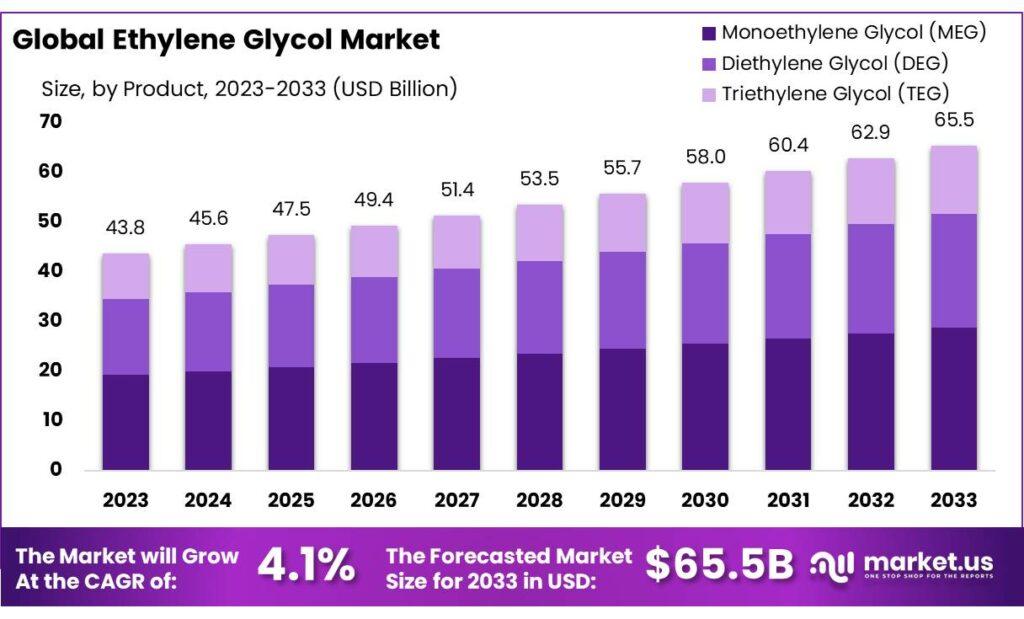

The global Ethylene Glycol Market size is expected to be worth around USD 65.5 billion by 2033, from USD 43.8 billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2033.

Ethylene glycol is a versatile organic compound primarily used as an antifreeze and coolant in automotive and industrial applications. Its properties include a high boiling point and low freezing point, making it essential for preventing engine overheating and freezing. Ethylene glycol is also a key raw material in the production of polyester fibers, resins, and films, widely utilized in textiles and packaging industries. Additionally, it serves as a solvent in various chemical processes. The compound's broad applications in automotive, textiles, and industrial sectors drive its significant demand and market growth.

Market Key Players:

-

SABIC

-

Dow Chemical Company

-

Sinopec Rashtriya Chemicals & Fertilizers Ltd.

-

Dyno Nobel

-

Sasol

-

Angus Chemical Company

-

Enaex S.A.

-

LSB Industries

-

Thyssenkrupp AG

-

Yara International ASA

-

Ixom

-

Shell Chemical

-

Formosa Plastics Group

-

Honam Petrochemicals

-

BASF SE

-

Dupont

-

Nutrien Ltd.

-

Omnia Holding Limited

-

Apache Nitrogen Products Inc.

-

CF Industry Holdings, Inc

-

Ineos

-

Nouryon

-

ExxonMobil

-

Reliance Industries Limited

Click here for request a sample : https://market.us/report/ethylene-glycol-market/request-sample/

By Product:

In 2023, Monoethylene Glycol (MEG) dominated the Ethylene Glycol Market with a 44.3% share, driven by its essential role in polyester fiber and PET production for textiles and packaging. MEG's use as a coolant and antifreeze further supports its market presence. Diethylene Glycol (DEG), although holding a smaller share, is vital for applications requiring higher boiling points, such as unsaturated polyester resins and plasticizers. Triethylene Glycol (TEG) is primarily used for its water-absorbing properties in natural gas dehydration and in products like air sanitizers and cement grinding aids.

By Purity:

In 2023, the "Up to 90%" purity category led the Ethylene Glycol Market with a 39.6% share due to its cost-effectiveness for industrial applications like antifreeze. The "91 to 95%" purity range caters to sectors needing slightly higher purity for quality assurance in chemical processes. The "Above 95%" purity category, though smaller, is crucial for high-end applications in pharmaceuticals and electronics where maximum purity is essential.

By Application:

In 2023, antifreeze and coolant applications held a dominant 41.2% share of the Ethylene Glycol Market, essential for engine performance in varying climates. Ethylene glycol is also key in polyester fiber production for textiles, and in making PET for recyclable plastic bottles in packaging. Its use in photographic films and other polymers highlights its versatility.

By End-use:

In 2023, the oil and gas sector led the Ethylene Glycol Market with a 43.2% share, using it extensively for natural gas dehydration to prevent pipeline issues. The medical sector utilizes ethylene glycol in device manufacturing and pharmaceutical formulations. The textile industry relies on it for polyester fiber production, while the plastic industry uses it for polyester resins and PET in packaging. Transportation uses ethylene glycol in antifreeze and coolant formulations to maintain vehicle engine performance.

Key Market Segments:

By Product

-

Monoethylene Glycol (MEG)

-

Diethylene Glycol (DEG)

-

Triethylene Glycol (TEG)

By Purity

-

Upto 90%

-

91 to 95%

-

Above 95%

By Application

-

Antifreeze and coolant

-

Film

-

Polyester Fiber

-

PET

-

Others

By End-use

-

Medical

-

Textile

-

Oil and Gas

-

Plastic

-

Transportation

-

Others

Drivers:

The surge in demand for Polyethylene Terephthalate (PET) packaging is a primary driver for the Ethylene Glycol Market. PET, used for containers and bottles, is favored for its clarity, strength, and recyclability, aligning with the push for sustainable packaging solutions. This demand is fueled by consumer preference for convenient, on-the-go products, global retail expansion, and technological advancements in PET production, such as lightweighting. Ethylene glycol's crucial role in PET production supports its market growth, driven by the balance of consumer needs, environmental responsibility, and economic efficiency.

Restraints:

Environmental concerns and regulatory challenges significantly restrain the Ethylene Glycol Market. The production and disposal of ethylene glycol, a petrochemical, involve processes that emit pollutants and greenhouse gases, attracting scrutiny from regulatory bodies. Stricter regulations increase costs for manufacturers who must adopt cleaner technologies and safer processes. The demand for bio-based alternatives further complicates the market, as traditional ethylene glycol faces competition from more sustainable options. Health risks associated with ethylene glycol exposure also influence market practices and consumer perceptions, especially in sensitive applications like food and beverage packaging.

Opportunity:

The expansion into bio-based ethylene glycol production presents a significant opportunity for the market. Produced from renewable resources, bio-based ethylene glycol meets the rising demand for sustainable products and aligns with global environmental goals. Technological advancements are making bio-based production more cost-effective, while tightening environmental regulations and eco-conscious consumers drive demand. Major industries such as automotive, textiles, and packaging seek sustainable materials, creating opportunities for bio-based ethylene glycol to meet performance and quality standards without compromising environmental integrity.

Trends:

A significant trend in the Ethylene Glycol Market is its increasing use in polyester fiber production, driven by the global textile industry's growth. Ethylene glycol is essential in producing durable, quick-drying polyester used in clothing, home furnishings, and industrial applications. The textile industry's shift towards sustainability, including recycling polyester garments and using recycled PET, underscores this trend. Emerging markets in Asia, particularly China and India, with their growing textile sectors and middle-class populations, further boost demand. Advancements in production technology enhance efficiency and cost-effectiveness, sustaining the increased use of ethylene glycol in polyester manufacturing.