Overview :

Curcumin Market size is expected to be worth around USD 426.4 Million by 2033, from USD 91.8 Million in 2023, growing at a CAGR of 16.6% during the forecast period from 2023 to 2033.

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/bakery-products-market/request-sample/

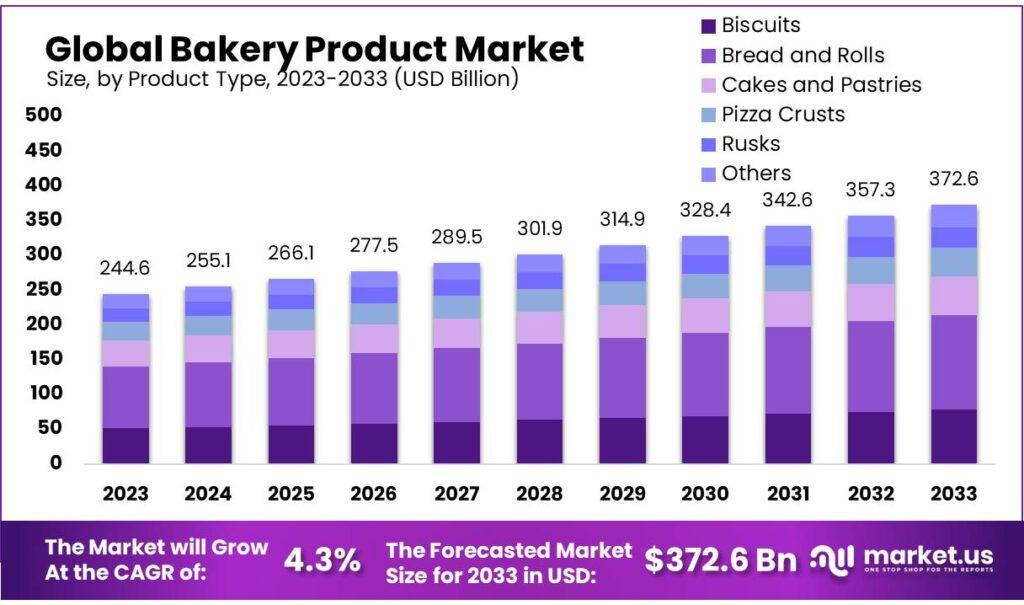

The bakery product market refers to the sector involved in the production, distribution, and consumption of various baked goods, including bread, cakes, pastries, and cookies. This market is experiencing growth due to the rising demand for ready-to-eat foods, which reflects a shift in consumer preferences toward convenience and quick meal solutions.

In Europe, there is a notable increase in the demand for bakery products driven by the popularity of ethnic cuisines, such as Mexican and Thai, which have found a strong foothold in restaurants and homes.Additionally, there is a growing trend towards healthier and organic bakery options. Consumers are increasingly seeking products that are perceived as healthier, such as whole wheat, light, and natural bakery items.

The demand for bakery products that are salt-free, fat-free, sugar-free, and gluten-free is rising among health-conscious individuals. This shift towards healthier options is contributing to the market's expansion, as more people choose baked goods that align with their dietary preferences and wellness goals.

Key Market Segments

By Product

-

Biscuits

-

Cookies

-

Non-Salt Cracker Biscuits

-

Salt Cracker Biscuits

-

Milk Biscuits

-

Cream Biscuits

-

Glucose Biscuits

-

Others

-

-

Bread and Rolls

-

Cakes and Pastries

-

Pizza Crusts

-

Rusks

-

Others

-

By Specialty Type

-

Gluten-free

-

Fortified

-

Organic

-

Low-calorie

-

Sugar-free

By Distribution Channel

-

Hypermarkets & Supermarkets

-

Specialty Store

-

Convenience Stores

-

Other Distribution Channel

Product Analysis:

In 2023, rolls and bread dominated the bakery product market, holding over 36.5% of the share due to their widespread popularity. The cakes and pastries segment is expected to lead in growth, driven by new flavors and rising disposable incomes.

By Specialty Type:

Gluten-free products captured over 26.4% of the market, reflecting increased demand from those with gluten sensitivities or seeking healthier options. Fortified baked goods and organic products also saw growth due to consumer interest in added nutrients and natural ingredients. Low-calorie and sugar-free options continued to gain traction among health-conscious consumers.

Distribution Channel Insights:

Hypermarkets and supermarkets led the bakery product distribution with over 42.6% market share, offering convenience and variety. Specialty stores are focusing on artisanal and functional bakery items, including innovative ingredients like probiotics and cereals, which boosts market growth.

Маrkеt Кеу Рlауеrѕ

-

Nestle S.A.

-

Mondelez International Inc.

-

Britannia Industries

-

Associated British Foods Plc

-

Finsbury Food Group Plc

-

Yamazaki Baking Co., Ltd.

-

The Great Canadian Bagel Ltd.

-

Canada Bread Company

-

Frank Roberts and Sons Ltd.

-

ARYZTA

Drivers:

The growth of the frozen food market is fueled by the increasing popularity of convenient, ready-to-eat meals that fit into busy lifestyles. Packaged frozen foods are favored for their ease of preparation and widespread availability, catering to consumers who seek quick and simple meal solutions.

Restraints:

The frozen food market faces challenges from the rising preference for fresh and natural products. Many consumers believe fresh foods are healthier and are inclined towards locally sourced, natural options, making it difficult for frozen food companies to compete on perceived quality and health benefits.

Opportunities:

Emerging economies with rising disposable incomes present significant growth opportunities for the frozen foods market. Increased international trade enables a diverse range of frozen meals, catering to various tastes and keeping prices competitive, thus expanding market reach and consumer interest.

Challenges:

Developing countries struggle with inadequate cold chain infrastructure, which is crucial for maintaining the quality and safety of frozen foods. Without proper systems to keep products consistently cold, there are risks of spoilage and higher costs, which hinder market growth in these regions.