Anatomic Pathology Industry Overview

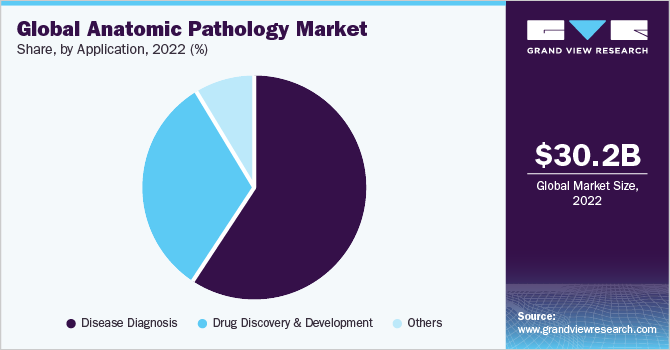

The global anatomic pathology market size was valued at USD 30.16 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030.

The growing adoption of biomarkers in clinical settings allows pathologists to gain insights into the molecular-level mechanisms. This valuable information not only helps in clinical decision-making but also contributes to enhancing patient outcomes. As a result, there is a rising dependence on pathology tests and procedures based on biomarkers to examine prevalent malignancies and tumorigenesis. This increasing reliance on biomarker-driven pathology is expected to drive the growth of the market.

The increasing adoption of advanced pathology equipment, including digital microscopes, gross imaging systems, and staining systems, is anticipated to significantly enhance anatomic pathological practices. Digital imaging solutions, in particular, offer significant advantages in terms of specificity and accuracy compared to conventional techniques. As a result, the adoption of these solutions in the market for anatomic pathology is experiencing an upsurge, driven by the increased demand for services that can provide improved diagnostic precision and reliability.

Gather more insights about the market drivers, restrains and growth of the Anatomic Pathology Market

Companies are undertaking continuous efforts for the development of advanced and upgraded pathology equipment with respect to their design and ease of use. For instance, in May 2021, OptraScan, a comprehensive on-demand digital pathology solutions and scanners provider for confocal, fluorescence, frozen sections, and brightfield applications announced the launch of CytoSiA, an intelligent solution designed to facilitate fast and cost-effective scanning and analysis of liquid-based cytology slides and pap-smears. This comprehensive solution encompasses OptraScan's digital pathology scanner, storage capabilities, and robust artificial intelligence (AI) algorithms. CytoSiA aims to support pathologists and cytotechnologists in their efforts to screen and detect various cytologic categories, including cervical cancer, pre-cancerous lesions, atypical cells, and more. By combining cutting-edge technology with advanced algorithms, CytoSiA enhances the efficiency and accuracy of cytology diagnostics in a streamlined manner.

Moreover, several partnerships and agreement ventures among key companies for the introduction of an effective portfolio are driving the market growth. For instance, in April 2021, Koninklijke Philips N.V. announced a partnership with Ibex Medical Analytics, an AI software developer, with the aim of advancing the adoption of their digital pathology products across global hospitals, health networks, and pathology laboratories. By integrating Philips' digital pathology solution with Ibex's Galen cancer platform, which is powered by artificial intelligence, the companies anticipate significant enhancements in reporting efficiency, with an estimated improvement of 27%, along with productivity gains of 37%. Moreover, this collaboration is expected to enhance diagnostic consistency and accuracy, ultimately benefiting healthcare providers and patients alike, as affirmed by both companies involved.

The growing focus on personalized medicine and the increasing incidence rate of cancer and other chronic disorders are some of the factors driving the market growth. Moreover, increasing reliance on biomarkers-based pathology procedures and tests to explore tumorigenesis and common malignancy is also driving the market. Clinically useful biomarkers are used for the development of diagnostic tests and therapeutic drugs. Pathological laboratories can rely on these biomarkers to detect & track infections and disease progression during diagnostic procedures. Hence, biomarkers are gaining ground as diagnostic and prognostic markers.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

- The global biomarkers market size was estimated at USD 81.04 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.36% from 2024 to 2030.

- The global personalized medicine market was valued at USD 529.28 billion in 2023 and is projected to grow at a CAGR of 8.20% from 2024 to 2030.

Anatomic Pathology Market Segmentation

Grand View Research has segmented the global anatomic pathology market on the basis of product and services, application, end-use, and region:

Anatomic Pathology Product & Services Outlook (Revenue in USD Million, 2018 - 2030)

Instruments

- Microtomes & Cryostat

- Tissue Processors

- Automatic Stainers

- Whole Slide Imaging (WSI) Scanners

- Other Products

Consumables

- Reagents & Antibodies

- Probes & Kits

- Others

- Services

Anatomic Pathology Application Outlook (Revenue in USD Million, 2018 - 2030)

- Disease Diagnosis

- Drug Discovery and Development

- Others

Anatomic Pathology End-use Outlook (Revenue in USD Million, 2018 - 2030)

- Hospitals

- Research Laboratories

- Diagnostic Laboratories

- Others

Anatomic Pathology Regional Outlook (Revenue in USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Danaher

- PHC Holdings Corporation

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- Hoffmann-La Roche AG

- Agilent Technologies, Inc.

- Cardinal Health

- Sakura Finetek USA, Inc.

- NeoGenomics Laboratories, Inc.

- BioGenex

- Bio SB

Key Anatomic Pathology Company Insights

Anatomic pathology is a mature industry with a large number of key players in it. The advent of new strategic plans to maintain competitiveness stimulates market growth. The market is well equipped with upcoming and innovative instruments and consumables to address the challenges in transforming pathology trends. For instance, in June 2022, EmeritusDX, a known cancer diagnostic & information company, acquired Freedom Pathology Partners to increase its reach and uplift its presence nationally in the Anatomic Pathology, Molecular testing, and Fluorescence in situ Hybridization. Additionally, in September 2021, F. Hoffmann-La Roche Ltd announced the launch of digital pathology open environment.

The new workflow allows researchers and physicians to sahare images for better analysis. Further, the platform is compatible with whole slide imaging technology. Similarly, in May 2021, F. Hoffmann-La Roche Ltd announced the merger with GenMark to expand and uplift its molecular diagnostic portfolio through GenMark’s ePlex system which will boost Roche’s work in managing antibiotic resistance and infectious diseases. Hence, the ongoing strategies adopted by key players boost the market growth as it helps retain their leadership in the market.

Order a free sample PDF of the Anatomic Pathology Market Intelligence Study, published by Grand View Research.