Pulse Oximeter Industry Overview

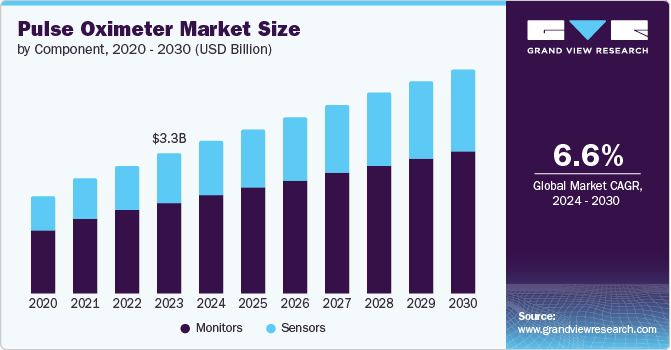

The global pulse oximeter market size was estimated at USD 3.3 billion in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030. The rising incidence of respiratory and cardiovascular diseases worldwide is expected to drive the demand for continuous monitoring devices, including pulse oximeters. According to World Health Federation 2023 insights, cardiovascular diseases impact over 500 million individuals globally, leading to 20.5 million fatalities in a year, which represents nearly one-third of all deaths worldwide. Moreover, factors such as technological advancements, strategic partnerships among key players, and the rising adoption of home healthcare & remote patient monitoring are driving the pulse oximeters market growth.

Gather more insights about the market drivers, restrains and growth of the Pulse Oximeter Market

Technological advancements in pulse oximeters have made them more accurate and cost-effective, driving market demand. Traditional pulse oximeters use transmittance technology, where light passes through tissue. In contrast, reflectance pulse oximetry measures light reflected from tissue, allowing more flexible placement, including on the forehead and chest, which is particularly useful for patients with poor peripheral circulation.

Increased Accuracy and Cost-Effectiveness: Technological advancements in pulse oximeters have made them more accurate and cost-effective, driving market demand. Traditional pulse oximeters use transmittance technology, where light passes through tissue. In contrast, reflectance pulse oximetry measures light reflected from tissue, allowing more flexible placement, including on the forehead and chest, which is particularly useful for patients with poor peripheral circulation.

For instance, in March 2023, OxiWear, a U.S.-based health technology startup, launched a wireless, ear-mounted pulse oximeter designed to continuously monitor oxygen levels and notify users of low oxygen. Equipped with an optical sensor and Bluetooth LE technology, it transmits health metrics to a smartphone app. In addition, it provides data on SpO2 levels and heart rate and allows users to specify emergency contacts.

The increasing incidence of respiratory disorders, fueled by factors such as overconsumption of alcohol & tobacco, sedentary lifestyles, unhealthy diets, and obesity, is expected to drive demand for technologically advanced pulse oximeters. For instance, statistics from the American College of Allergy, Asthma & Immunology in June 2023, indicate that approximately 7.7% of Americans suffer from asthma. Furthermore, the following figure depicts the projected proportion of deaths attributed to leading respiratory causes, highlighting the critical need for advanced monitoring technologies in healthcare settings.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global newborn screening market size was valued at USD 789.35 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.54% from 2023 to 2030.

- The global radiation dose monitoring market size was valued at USD 3.44 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030.

Pulse Oximeter Market Segmentation

Grand View Research has segmented the global pulse oximeter market based on component, type, age group, end use, and region:

Pulse Oximeter Component Outlook (Revenue, USD Million, 2018 - 2030)

- Monitors

- Sensors

Pulse Oximeter Type Outlook (Revenue, USD Million, 2018 - 2030)

- Portable Pulse Oximeter

- Tabletop/Bed side Pulse Oximeter

Pulse Oximeter Age Group Outlook (Revenue, USD Million, 2018 - 2030)

- Adult

- Pediatric

Pulse Oximeter End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Home Care

- Outpatient Facilities

- Others

Pulse Oximeter Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Medtronic

- Masimo

- Koninklijke Philips N.V.

- GE HealthCare

- Nonin

- NIHON KOHDEN CORPORATION

- ICU Medical, Inc.

- OSI Systems, Inc.

- CONTEC MEDICAL SYSTEMS CO., LTD

- Drägerwerk AG & Co. KGaA

Recent Developments

- In May 2024, Masimo partnered with Medable Inc. to integrate medical-grade wearable devices into clinical research. Medable incorporated Masimo’s MightySat Rx pulse oximeter in its evidence-generation platform for eight large-scale pharmaceutical clinical trials. These trials, involving over 3,000 patients across 25 countries, are focused on two oncology indications: breast and lung cancer.

- In May 2024, Masimo announced FDA clearance for a baby monitoring system, Stork, designed for healthy infants aged 0 to 18 months without the need for a prescription. Stork utilizes the pulse oximetry technology used in Neonatal Intensive Care Units (NICU) to monitor key vital signs such as PR, Oxygen Saturation Level (SpO2), and skin temperature, providing alarms to parents or caregivers.

- In April 2024, Nonin partnered with Medixine to develop remote digital monitoring services to enhance patient-centric diagnosis of chronic conditions. This collaboration integrates Medixine’s remote patient monitoring digital software platform with Nonin’s pulse oximetry devices in the U.S. market.

Order a free sample PDF of the Pulse Oximeter Market Intelligence Study, published by Grand View Research.