"Global Risk Management Market – Industry Trends and Forecast to 2030

Global Risk Management Market, By Risk Type (Compliance Risk, Financial and Credit Risk, Security Risk, Operational Risk, Strategic Risk, and Legal Risk), Firm Type (Enterprise Risk Management (ERM) Consulting Firm, Independent Insurable Property and Casualty Risk Management/Risk Engineering Consulting Firm, and Logistic & Transport Risk Management Consulting Firm), Enterprise Size (Large Enterprises and Small & Medium Enterprises), Vertical (BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Government & Defence, Transport & Logistic, Energy & Utilities, and Others) - Industry Trends and Forecast to 2030.

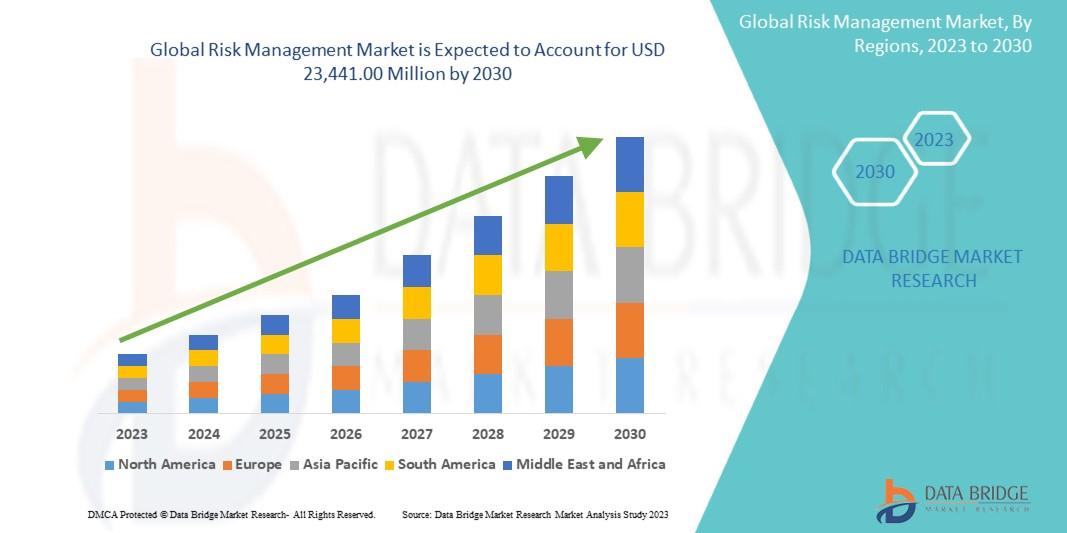

The global risk management market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 16.8% in the forecast period of 2023 to 2030 and is expected to reach USD 23,441.00 million by 2030. Increasing demand for R&D activities is expected to drive market growth.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-risk-management-market

The global risk management market includes a diverse set of products, services, and methods aimed to assist organizations in identifying, assessing, and mitigating possible threats to their operations, assets, and goals. Risk assessment tools, insurance products, financial hedging instruments, compliance and governance solutions, cybersecurity measures, and advisory services are all available. Its primary goal is to enable businesses and institutions to proactively manage and minimize the impact of various risks, such as financial, operational, strategic, regulatory, and technical risks, to protect their stability, reputation, and long-term success in an ever-changing and challenging business environment.

**Segments**

- **Type**: The risk management market can be segmented based on type into strategic risk, operational risk, financial risk, compliance risk, and others. Each type addresses specific challenges faced by organizations in different areas of their operations, allowing them to implement targeted risk management strategies.

- **Deployment**: Deployment segments in the risk management market include on-premises and cloud-based solutions. Cloud-based solutions are gaining popularity due to their scalability, flexibility, and cost-effectiveness, enabling businesses to access risk management tools from anywhere.

- **Industry Vertical**: The market can also be segmented based on industry verticals such as banking, financial services, insurance, healthcare, IT and telecom, manufacturing, and others. Different industries have unique risk profiles, requiring tailored risk management solutions to mitigate threats effectively.

**Market Players**

- **IBM Corporation**: IBM offers a comprehensive risk management suite that leverages advanced analytics, AI, and automation to help businesses identify and address risks proactively.

- **SAP SE**: SAP provides integrated risk management solutions that enable organizations to assess, mitigate, and monitor risks across various business processes in real-time.

- **Oracle Corporation**: Oracle's risk management solutions help businesses streamline risk identification, evaluation, and response through a single, integrated platform.

- **Deloitte**: Deloitte offers risk advisory services that assist organizations in developing robust risk management frameworks aligned with their business objectives.

- **Marsh & McLennan Companies**: Marsh & McLennan Companies provide risk consulting and insurance brokerage services to help businesses optimize their risk management practices and insurance coverage.

The global risk management market is witnessing significant growth attributable to the escalating need for effective risk mitigation strategies in organizations worldwide. The market segmentation based on type allows businesses to address specific risk categories with targeted solutions tailored to their requirements. Deployment options cater to the evolving preferences of businesses towards cloud-based solutions for enhanced accessibility and scalability. Industry vertical segmentation enables the customization of risk management tools to fit the unique risk profiles of different sectors, fostering adoptionThe global risk management market is experiencing robust growth driven by the increasing need for organizations to implement effective strategies to mitigate risks across various facets of their operations. The segmentation of the market based on types of risks such as strategic, operational, financial, compliance, and others allows companies to tailor their risk management approaches to address specific challenges they face. By having specialized solutions for different types of risks, businesses can enhance their overall risk management capabilities and improve their resilience in the face of uncertainties.

In terms of deployment, the market is divided into on-premises and cloud-based solutions. The rising popularity of cloud-based risk management tools can be attributed to their scalability, flexibility, and cost-effectiveness. Cloud solutions enable organizations to access risk management platforms from anywhere, facilitating seamless collaboration and real-time decision-making. As businesses increasingly prioritize mobility and remote accessibility, the demand for cloud-based risk management solutions is expected to continue growing, reshaping the market landscape.

Furthermore, industry vertical segmentation plays a crucial role in tailoring risk management solutions to specific sectors such as banking, financial services, insurance, healthcare, IT and telecom, manufacturing, and others. Different industries have distinct risk profiles and regulatory requirements, necessitating industry-specific risk management approaches. By segmenting the market based on industry verticals, providers can offer specialized solutions that cater to the unique needs and challenges of each sector, thereby driving adoption and fostering innovation in risk management practices.

Key market players such as IBM Corporation, SAP SE, Oracle Corporation, Deloitte, and Marsh & McLennan Companies play a pivotal role in driving the growth and evolution of the risk management market. These companies offer cutting-edge risk management solutions that leverage advanced technologies such as artificial intelligence, analytics, and automation to help organizations proactively identify, assess, and mitigate risks. By providing integrated risk management platforms that streamline risk identification, evaluation, and response processes, these market players empower businesses to enhance their risk management frameworks and improve decision-making.

In conclusion, the global risk management market is poised**Global Risk Management Market, By Risk Type (Compliance Risk, Financial and Credit Risk, Security Risk, Operational Risk, Strategic Risk, and Legal Risk), Firm Type (Enterprise Risk Management (ERM) Consulting Firm, Independent Insurable Property and Casualty Risk Management/Risk Engineering Consulting Firm, and Logistic & Transport Risk Management Consulting Firm), Enterprise Size (Large Enterprises and Small & Medium Enterprises), Vertical (BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Government & Defence, Transport & Logistic, Energy & Utilities, and Others) - Industry Trends and Forecast to 2030.**

- The global risk management market is experiencing robust growth driven by the increasing need for organizations to implement effective strategies to mitigate risks across various facets of their operations. The segmentation of the market based on types of risks such as compliance, financial, security, operational, strategic, and legal allows companies to tailor their risk management approaches to address specific challenges they face. By having specialized solutions for different types of risks, businesses can enhance their overall risk management capabilities and improve their resilience in the face of uncertainties.

- In terms of deployment, the market is divided into on-premises and cloud-based solutions. The rising popularity of cloud-based risk management tools can be attributed to their scalability, flexibility, and cost-effectiveness. Cloud solutions enable organizations to access risk management platforms from anywhere, facilitating seamless collaboration and real-time decision-making.

- Industry vertical segmentation plays a crucial role in tailoring risk management solutions to specific sectors

Core Objective of Risk Management Market:

Every firm in the Risk Management Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.

- Size of the Risk Management Market and growth rate factors.

- Important changes in the future Risk Management Market.

- Top worldwide competitors of the Market.

- Scope and product outlook of Risk Management Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Market.

- Global Risk Management top manufacturers profile and sales statistics.

Key takeaways from the Risk Management Market report:

- Detailed considerate of Risk Management Market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

- Comprehensive valuation of all prospects and threat in the

- In depth study of industry strategies for growth of the Risk Management Market-leading players.

- Risk Management Market latest innovations and major procedures.

- Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

- Conclusive study about the growth conspiracy of Risk Management Market for forthcoming years.

Frequently Asked Questions

- What is the Future Market Value for Risk Management Market?

- What is the Growth Rate of the Risk Management Market?

- What are the Major Companies Operating in the Risk Management Market?

- Which Countries Data is covered in the Risk Management Market?

- What are the Main Data Pointers Covered in Risk Management Market Report?

Browse Trending Reports:

Name System Firewall Market

Magnetic Field Sensors Market

Plant Antifreeze Market

Bakeware Market

Vernal Keratoconjunctivitis Treatment Market

Pallet Pooling Market

Heating Ventilation And Air Conditioning Hvac Control Systems At Workplace Market

Pesto Based Pasta Sauce Market

Green Petroleum Coke And Calcined Petroleum Coke Market

Active Metal Brazed Amb Ceramic Substrate Market

Gaming Steering Wheels Market

Data Compression Software Market

Mandibular Osteomyelitis Treatment Market

Makeup Remover Market

High Density Polyethylene Terephthalate Pet Foam Market

Cold Laser Therapy Market

Application Processor Market

Physiotherapy Examination Tables Market

Label Printing Machines Market

Tabletop Kitchen Products Market

Image Based Barcode Reader Market

Food And Beverages Nutraceutical Ingredients Market

Tennis Racquet Market

Chipboard Packaging Market

Watertight Doors Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975