"Multivendor ATM Software Market – Industry Trends and Forecast to 2028

Global Multivendor ATM Software Market, By Function (Card Payment, Bill Payment, Cash/ Cheque Dispenser, Passbook Printer, Cash/Cheque Deposit, Others), Component (Service, Software), End User (Independent ATM Deployer, Bank and Financial Institutions), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

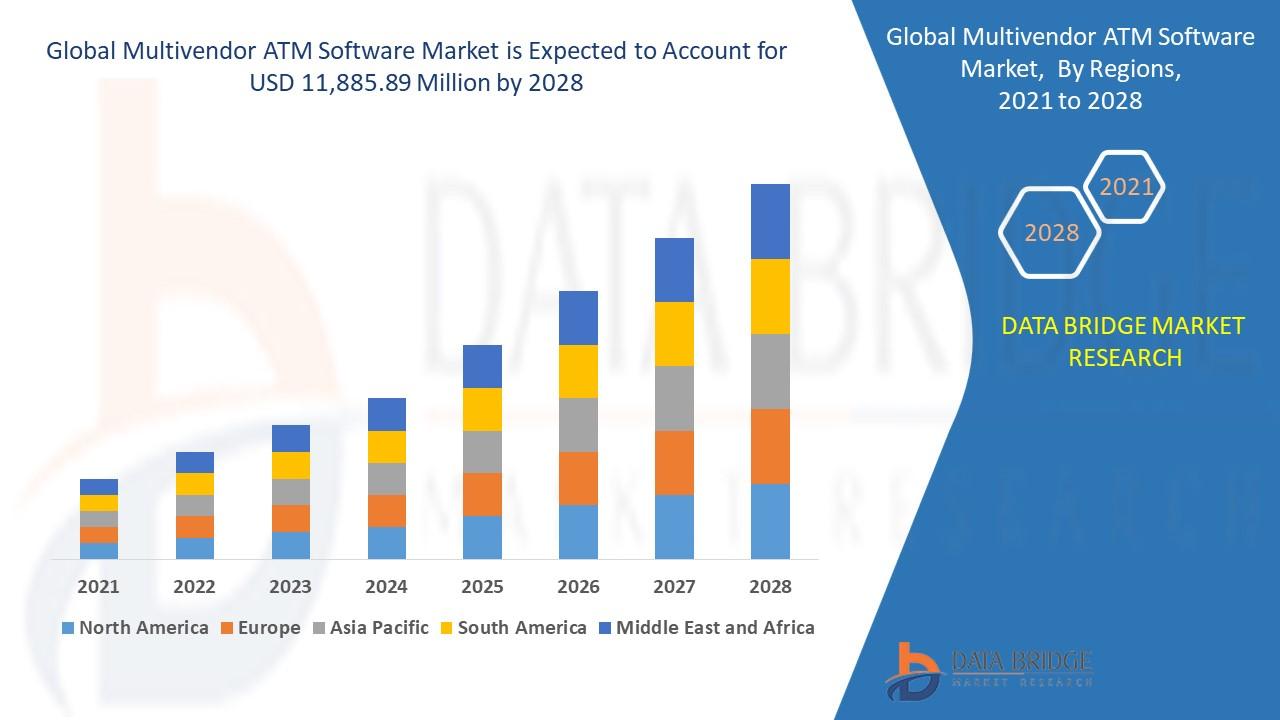

The multivendor ATM software market is expected to witness market growth at a rate of 24.0% in the forecast period of 2021 to 2028, and is estimated to reach the value of USD 11,885.89 million by 2028. Data Bridge Market Research report on multivendor ATM software market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rise in the demand from various industry verticals is escalating the growth of multivendor ATM software market.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-multivendor-atm-software-market

Multivendor ATM software refers to the type of software that allows banks and financial institutions in taking control of their ATM networks to decline costs, improve competitiveness and increase functionality. The need to acquire innovative financial self-service equipment from different manufacturers has been discovered by many financial institutions.

**Segments**

- Deployment Type: The multivendor ATM software market can be segmented based on deployment type into on-premises and cloud-based solutions. On-premises deployment provides greater control and security for financial institutions, while cloud-based solutions offer scalability and flexibility.

- Functionality: This segment categorizes the market based on the different functionalities provided by the software, such as cash management, security features, remote monitoring, and analytics. Each functionality plays a crucial role in enhancing the efficiency and security of ATM operations.

- End-User: The end-user segment includes banks, financial institutions, retail stores, and standalone ATMs. Understanding the specific needs and requirements of each end-user group is vital for software providers to deliver customized solutions that meet their business objectives effectively.

**Market Players**

- NCR Corporation: NCR Corporation is a prominent player in the multivendor ATM software market, offering a range of solutions for financial institutions and retail businesses. Their software solutions focus on security, compliance, and seamless integration with existing ATM networks.

- Diebold Nixdorf: Diebold Nixdorf is another key player known for its innovative approach to multivendor ATM software. Their solutions aim to enhance customer experience, increase operational efficiency, and drive revenue growth for ATM operators.

- GRG Banking: GRG Banking is a leading provider of multivendor ATM software with a strong focus on technology innovation and customer satisfaction. Their software solutions are designed to meet the evolving needs of the financial industry and deliver a competitive edge to ATM operators.

The multivendor ATM software market is witnessing significant growth due to the increasing demand for secure and efficient ATM operations. With the rise of digital banking and cashless transactions, financial institutions are looking for advanced software solutions that can streamline their ATM management processes. The segmentation based on deployment type, functionality, and end-user helps software providers understand the diverse requirements of the market and tailor their offerings accordingly. Leading market players like NCR Corporation, Diebold Nixdorf,The market for multivendor ATM software is experiencing steady growth propelled by the surging demand for secure and efficient ATM operations. As the financial industry continues to embrace digital banking and cashless transactions, the need for advanced software solutions to streamline ATM management processes becomes increasingly vital. This trend is driving financial institutions and ATM operators to adopt sophisticated multivendor ATM software that offers enhanced security, compliance, and operational efficiency. The market segmentation based on factors like deployment type, functionality, and end-user helps software providers target specific needs and deliver tailored solutions that align with the diverse requirements of the industry.

In terms of deployment type, the choice between on-premises and cloud-based solutions plays a pivotal role in shaping the market dynamics. On-premises deployment provides financial institutions with greater control and security over their ATM software systems. This setup is preferred by organizations that prioritize data privacy and regulatory compliance. On the other hand, cloud-based solutions offer scalability and flexibility, allowing ATM operators to easily expand their operations and adapt to changing market conditions. The adoption of cloud-based multivendor ATM software is expected to increase as organizations seek more agile and cost-effective solutions.

Functionality is another key segment that drives the multivendor ATM software market forward. The diverse range of functionalities provided by the software, such as cash management, security features, remote monitoring, and analytics, are crucial for optimizing ATM operations. Cash management features help organizations efficiently manage cash supplies in ATMs, reducing downtime and improving operational efficiency. Security features play a vital role in safeguarding ATM transactions and protecting against fraud and data breaches. Remote monitoring capabilities enable real-time monitoring of ATM networks, ensuring proactive maintenance and timely issue resolution. Analytics functionalities provide valuable insights into ATM performance, customer behavior, and trends, enabling organizations to make data-driven decisions and enhance customer experience.

The end-user segment encompasses various entities, including banks, financial institutions, retail stores, and standalone ATMs. Each end-user group has specific requirements and objectives that influence their choice of multiv**Global Multivendor ATM Software Market**

- **Function**: The market for multivendor ATM software is segmented based on various functions, including card payment, bill payment, cash/cheque dispenser, passbook printer, cash/cheque deposit, and others. Each function serves a specific purpose in optimizing ATM operations and enhancing customer experience.

- **Component**: The market is categorized based on components such as service and software. Service components focus on maintenance, support, and training services, while software components include the core software solutions that power multivendor ATM operations.

- **End User**: The end-user segment includes independent ATM deployers, banks, and financial institutions. Understanding the distinct needs and preferences of each end-user category is essential for software providers to deliver tailored solutions that address specific business requirements effectively.

The global multivendor ATM software market is witnessing steady growth driven by the increasing demand for secure and efficient ATM operations. The adoption of digital banking and cashless transactions is fueling the need for advanced software solutions that can streamline ATM management processes and improve operational efficiency. Market segmentation based on deployment type, functionality, and end-user helps software providers align their offerings with the diverse requirements of the industry and target specific customer segments effectively.

In terms of deployment type, the choice between on-premises and cloud-based solutions significantly impacts market dynamics. While on-premises deployment offers greater control and security for financial institutions, cloud-based solutions provide scalability and flexibility, enabling ATM operators to adapt to changing market

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Multivendor ATM Software Market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

- Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

- Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Multivendor ATM Software Market.

Global Multivendor ATM Software Market survey report analyses the general market conditions such as product price, profit, capacity, production, supply, demand, and market growth rate which supports businesses on deciding upon several strategies. Furthermore, big sample sizes have been utilized for the data collection in this business report which suits the necessities of small, medium as well as large size of businesses. The report explains the moves of top market players and brands that range from developments, products launches, acquisitions, mergers, joint ventures, trending innovation and business policies.

The following are the regions covered in this report.

- North America [U.S., Canada, Mexico]

- Europe [Germany, UK, France, Italy, Rest of Europe]

- Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

- South America [Brazil, Argentina, Rest of Latin America]

- The Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

This study answers to the below key questions:

- What are the key factors driving the Multivendor ATM Software Market?

- What are the challenges to market growth?

- Who are the key players in the Multivendor ATM Software Market?

- What are the market opportunities and threats faced by the key players?

Browse Trending Reports:

Ammonium Salts Market

Gan And Sic Power Semiconductor Market

Graves Disease Treatment Market

Pulse Protein Market

Cold Chain Monitoring Components Market

Food Supplements Market

Xylose Market

Pulse Starch Market

Silicon Nitride Market

Alagille Syndrome Market

Forceps And Spatulas Market

Dairy Products Transport Market

Uht Milk Products Market

Stereotactic Surgery Market

Cryptocurrency Mining Market

Green Technology And Sustainability Market

Network Security Software Market

Cyanide Poisoning Treatment Market

Aluminum Pigments Market

Technical Enzymes Market

Pentane Market

Myelodysplastic Syndromes Market

Processing Seals For Dairy Products Market

Natural Killer Nk Cell Therapeutics Market

Medical Device Outsourcing Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975